does maine tax retirement pensions

MaineSTART offers tax advantaged retirement savings plans. According to the Maine Department of Revenue Military pension benefits including survivor benefits will be completely exempt from the State of Maines income tax.

15 States That Don T Tax Retirement Income Pensions Social Security

Save Time With ReadyChoice.

. Reduced by social security received. In addition for Louisiana individual income tax purposes retirement benefits paid under the provisions of Chapter 1 Title 11 of the Louisiana Revised Statutes including. Highest marginal tax rate.

Ad Discover New More Personalized Approach To Helping You Plan Your Retirement With Merrill. These voluntary programs can help eligible public school teachers supplement their retirement. For tax year 2004 the maximum exemption is 40200.

In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who. The 10000 must be. Maine Public Employees Retirement.

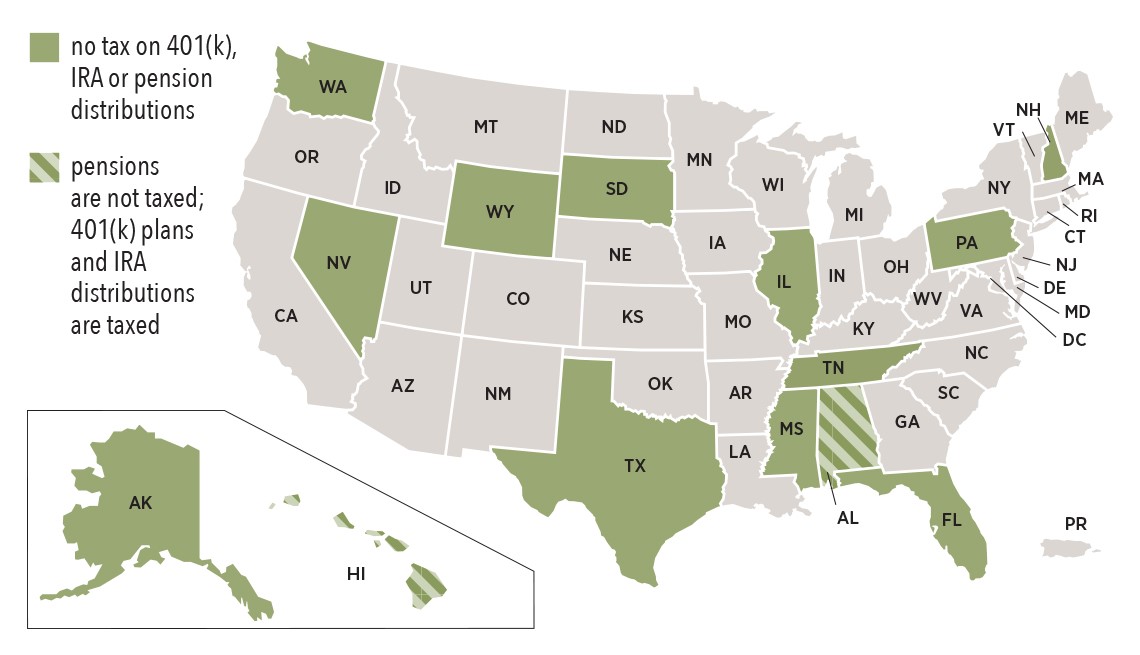

You have to pay income tax on your pension and on withdrawals from any tax-deferred investmentssuch as traditional IRAs 401 ks 403 bs. Ad Choose a New Traditional or Roth IRA Get Retirement Fund Recommendation Based on Age. Taxes on Pension Income.

An IRA Solution that Can Help You Reach Your Retirement Goals. Arizonas exemption is even lower 2500. How Are Teacher Pensions Calculated in Maine.

Benefit Payment and Tax Information. Pension wealth is derived from a formula. June 6 2019 239 AM.

You will have to. 52 rows Maine. Military retirement pay is exempt beginning Jan.

In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify. Maine does not tax active Military pensions - AT ALL. MA pensions qualify for the pension exemption.

Maine tax law allows for a pension income deduction to all its pensioners on Schedule 1. MA pensions qualify for a pension exemption. Deduct up to 10000 of pension and annuity income.

Ad Discover New More Personalized Approach To Helping You Plan Your Retirement With Merrill. Maine allows for a deduction of up to 10000 per year on pension income. Is my retirement income taxable to Maine.

Maine Revenue Services processes the Income Tax Withholding Quarterly Return Form 941ME as well as the Unemployment Contributions Report Form ME UC-1. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. The figure below illustrates how a teacher pension is calculated in Maine.

However that deduction is reduced in an amount equal to your annual. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. You also need to consider Maine retirement taxes as they apply to pensions and distributions when choosing a place to settle after working for so many years.

454 for income above 150000 individuals or 300000 married filing jointly.

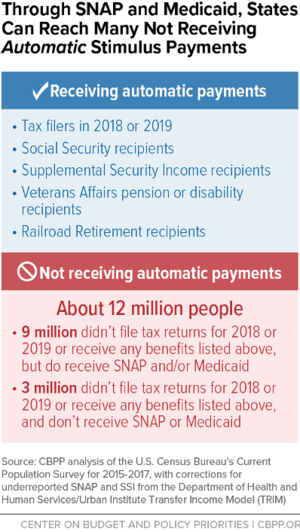

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

Tax Withholding For Pensions And Social Security Sensible Money

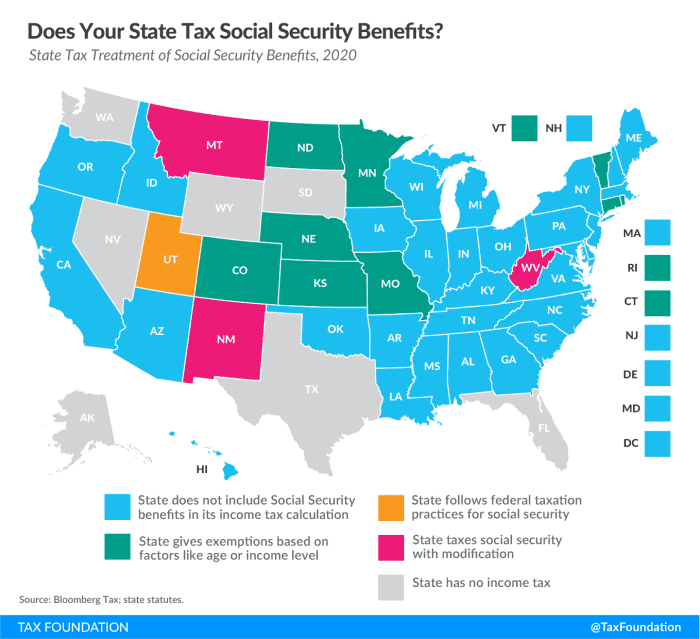

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022 Marketwatch

What Happens To Taxpayer Funded Pensions When Public Officials Are Convicted Of Crimes Reason Foundation

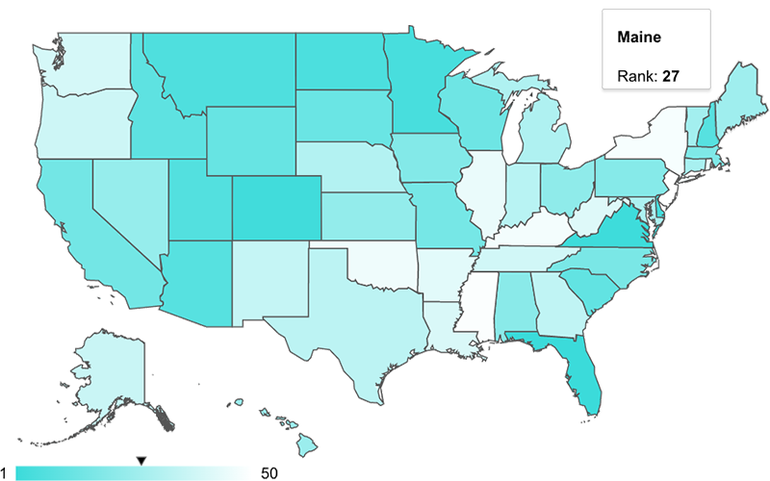

Where Do Americans Take Their Retirement Income Tax Foundation

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

Retiring These States Won T Tax Your Distributions

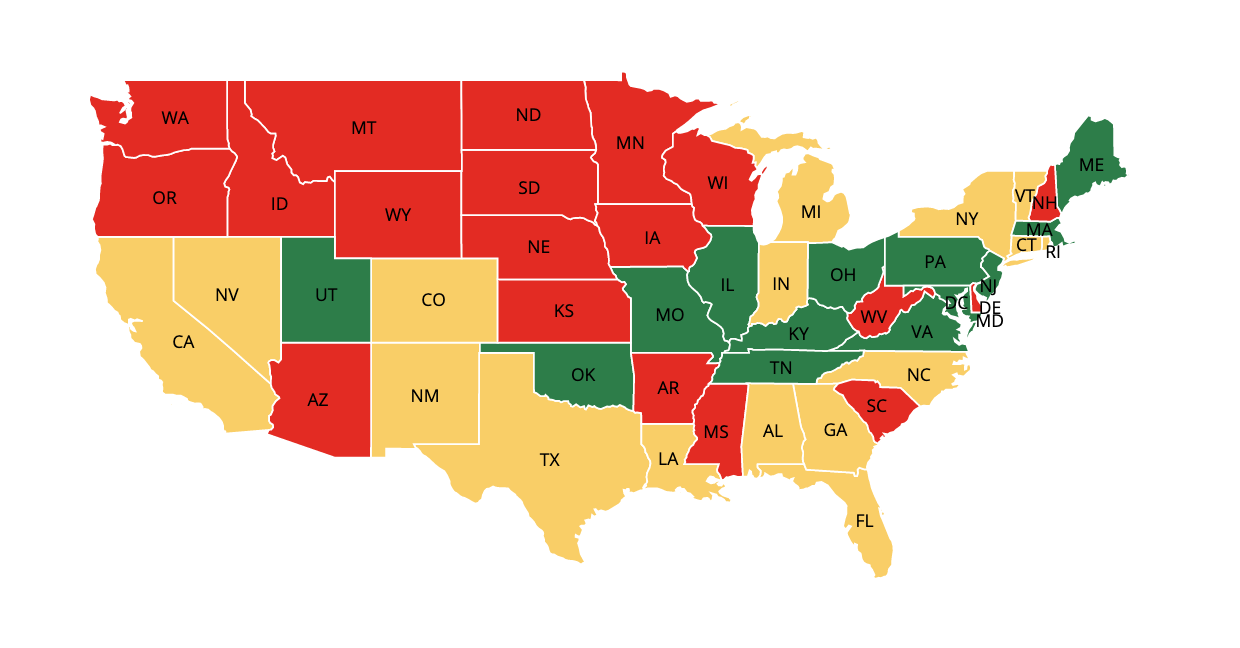

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

12 States That Keep Retirement Dollars In Your Pocket Alhambra Investments

Tax Friendly States That Don T Tax Pensions Or Social Security Sofi

Mar News Maine Association Of Retirees Farmingdale

Maine Among Priciest States To Retire Study Says Mainebiz Biz

States Compete For Military Retirees The Pew Charitable Trusts

![]()

Opinion New Tax Relief Plan Will Disproportionately Benefit Wealthy Seniors Maine Beacon

Retirement Asset Division In A Maine Divorce The Maine Divorce Group

Maine Lawmaker Wants To Remove Income Tax On State Pensions Wgme